UnlimitedStrategy

No content yet

UnlimitedStrategy

Macro Watch: Inflation Data to Guide Fed Decisions

White House Economic Council Chair Hassett said that upcoming inflation data will significantly influence future Federal Reserve decisions.

Reports indicate that inflation figures are a main factor for policymakers when determining interest rate direction and broader monetary policy changes.

Key points

- Inflation data is central to Fed policy decisions

- Rate outlook is closely linked to economic indicators

- Markets are likely to respond to upcoming CPI releases

With inflation still a priority, investors are closely monitoring

White House Economic Council Chair Hassett said that upcoming inflation data will significantly influence future Federal Reserve decisions.

Reports indicate that inflation figures are a main factor for policymakers when determining interest rate direction and broader monetary policy changes.

Key points

- Inflation data is central to Fed policy decisions

- Rate outlook is closely linked to economic indicators

- Markets are likely to respond to upcoming CPI releases

With inflation still a priority, investors are closely monitoring

BTC-4,59%

- Reward

- like

- 1

- Repost

- Share

Lock_433 :

:

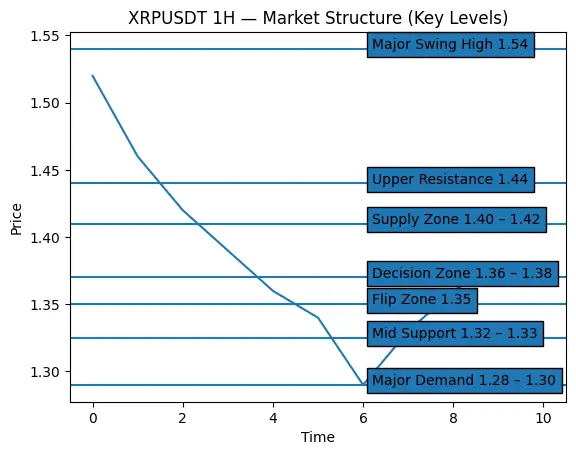

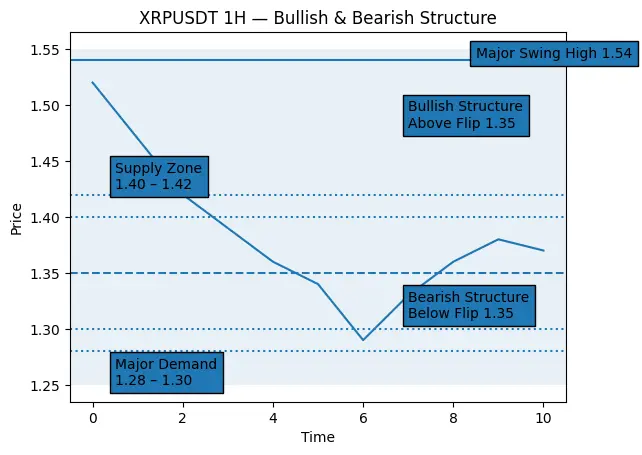

Buy To Earn 💎Market Is Moving, But Structure Still Decides $XRP

Price is reacting, and emotions are rising, but this is not the time to rush decisions.

Fast candles attract attention. Key levels reveal intent.

After the recent selloff, XRP is trying to stabilize near a critical reaction area. The volatility phase has done its job; now the market is testing whether buyers can defend structure or if this is just temporary relief.

Current Structure Breakdown (1H)

Major Swing High: ~1.54, clear distribution and rejection

Supply Zone: 1.40 to 1.42, heavy overhead pressure

Decision Zone: 1.36 to 1

Price is reacting, and emotions are rising, but this is not the time to rush decisions.

Fast candles attract attention. Key levels reveal intent.

After the recent selloff, XRP is trying to stabilize near a critical reaction area. The volatility phase has done its job; now the market is testing whether buyers can defend structure or if this is just temporary relief.

Current Structure Breakdown (1H)

Major Swing High: ~1.54, clear distribution and rejection

Supply Zone: 1.40 to 1.42, heavy overhead pressure

Decision Zone: 1.36 to 1

XRP-3,45%

- Reward

- like

- Comment

- Repost

- Share

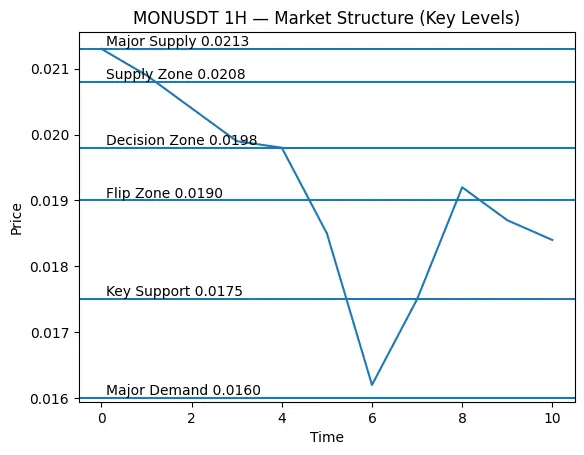

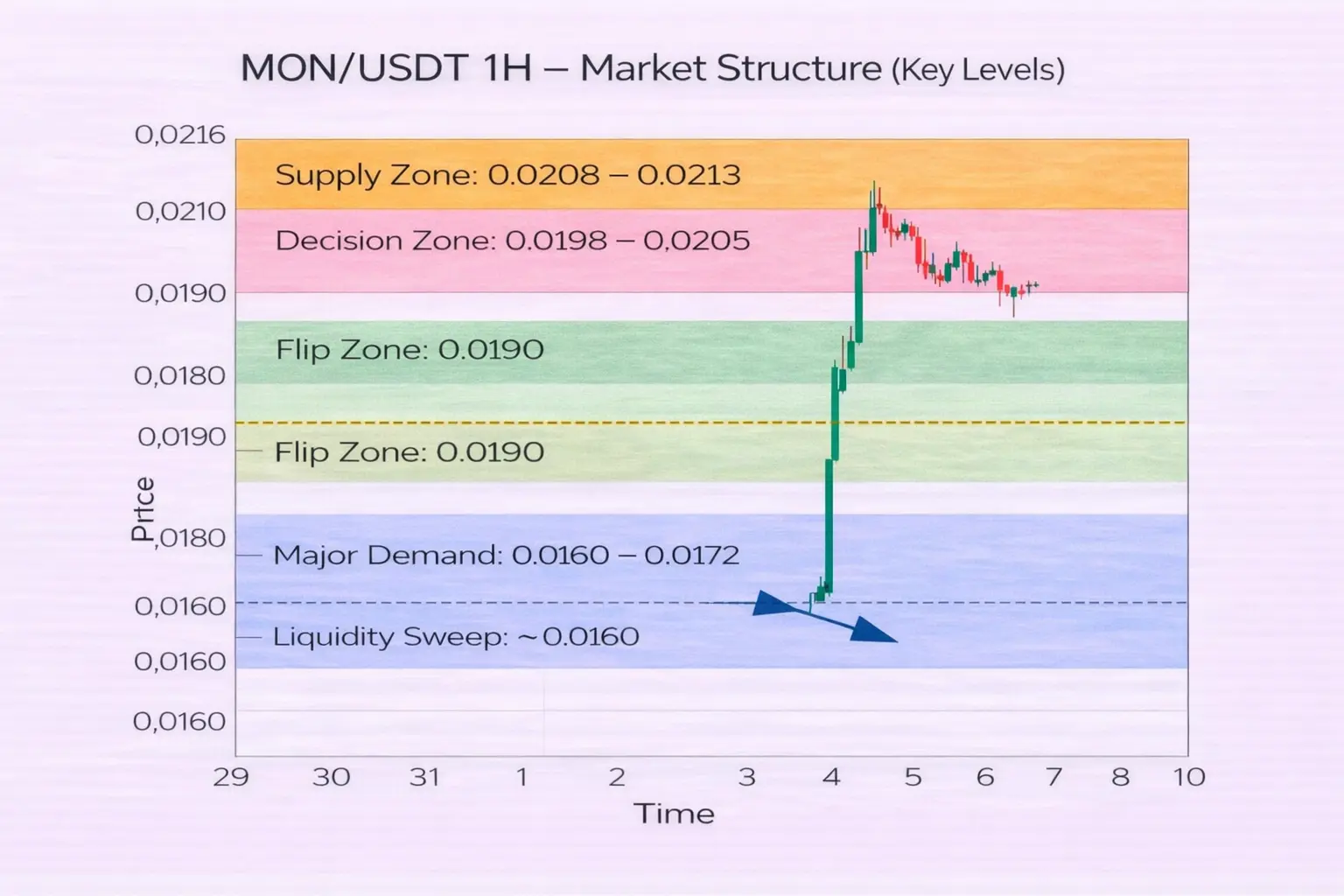

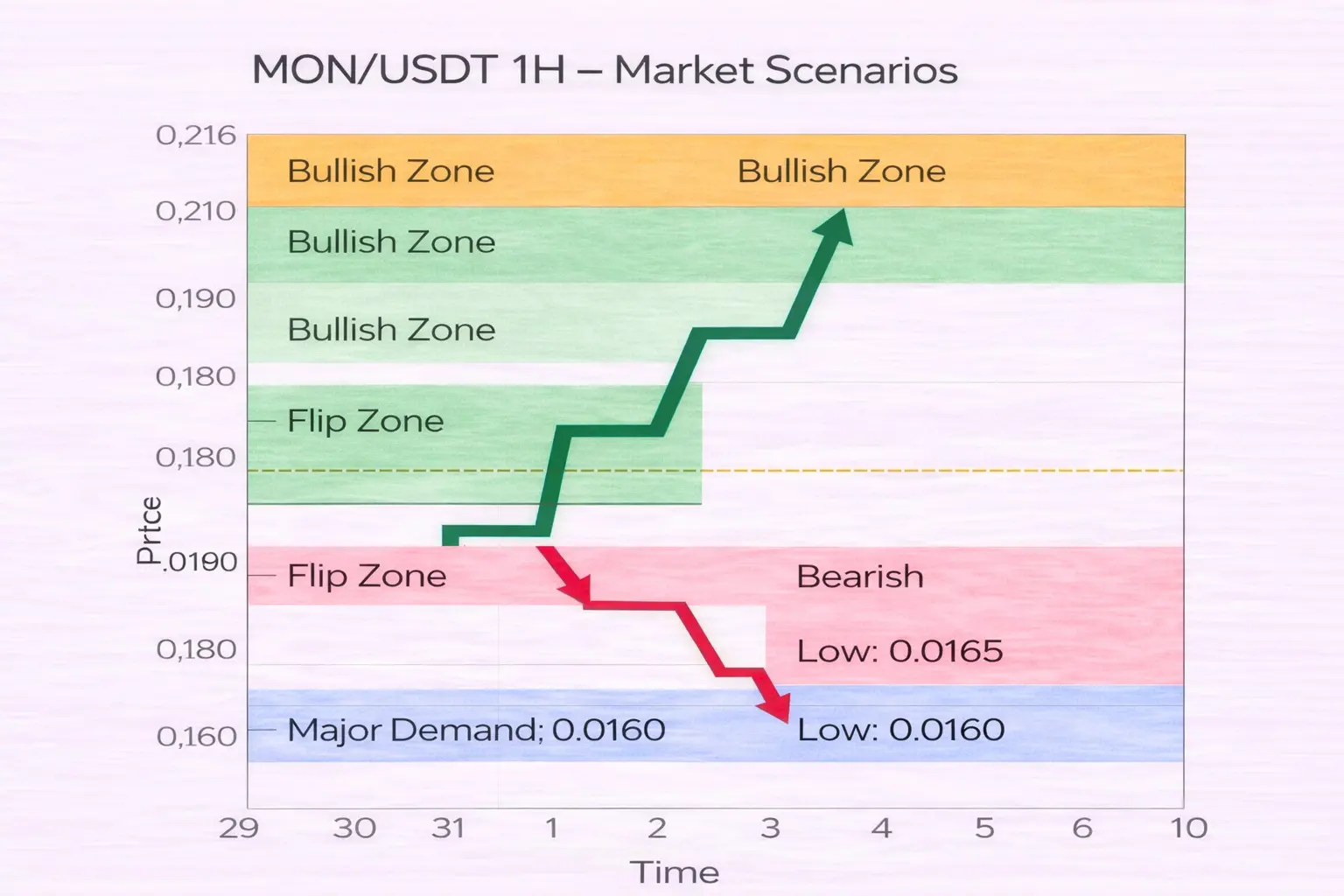

Market Is Moving, But Structure Still Decides,$MON

MON just experienced a sharp expansion after a quiet phase, but this isn't the time for disciplined traders to act impulsively.

Large candles grab attention.

Structure shows intent.

After a clear impulsive move from the lower range, price is now stabilizing near a key intraday decision area. This phase focuses on acceptance and positioning, not excitement.

Current Structure Breakdown (1H)

- Major Spike High: ~0.0213, emotional expansion, not stable pricing

- Supply Zone: 0.0208 – 0.0213, visible reaction zone

- Decision Zone:

MON just experienced a sharp expansion after a quiet phase, but this isn't the time for disciplined traders to act impulsively.

Large candles grab attention.

Structure shows intent.

After a clear impulsive move from the lower range, price is now stabilizing near a key intraday decision area. This phase focuses on acceptance and positioning, not excitement.

Current Structure Breakdown (1H)

- Major Spike High: ~0.0213, emotional expansion, not stable pricing

- Supply Zone: 0.0208 – 0.0213, visible reaction zone

- Decision Zone:

MON-9,08%

- Reward

- 1

- Comment

- Repost

- Share

Goldman Sachs has increased its holdings in Strategy by 237,874 shares, raising the total position value above $300 million. This update highlights ongoing interest from institutions in companies connected to Bitcoin through corporate treasury strategies.

Key points:

- 237,874 additional shares acquired

- Total holdings now around 2.33 million shares

- Position value stands at approximately $301 million

- Exposure gained through equity, not direct BTC purchase

Instead of buying Bitcoin directly, Goldman Sachs is boosting its exposure through Strategy stock, a company known for holdi

Key points:

- 237,874 additional shares acquired

- Total holdings now around 2.33 million shares

- Position value stands at approximately $301 million

- Exposure gained through equity, not direct BTC purchase

Instead of buying Bitcoin directly, Goldman Sachs is boosting its exposure through Strategy stock, a company known for holdi

BTC-4,59%

- Reward

- like

- Comment

- Repost

- Share

Market Reset: Tom Lee Shares a New Buying Logic for Bitcoin and Ethereum

After sharp pullbacks in crypto, many investors focus on one question: Where is the bottom?

According to Tom Lee, that might be the wrong question. At the Hong Kong Consensus 2026 conference, he said investors should stop trying to perfectly predict market bottoms. Instead, he suggested looking for strong entry points when prices drop.

Key points:

- Don’t obsess over calling the exact bottom

- Look for good entry opportunities during corrections

- Focus on long-term value, not short-term fear

- Think about opportunity, n

After sharp pullbacks in crypto, many investors focus on one question: Where is the bottom?

According to Tom Lee, that might be the wrong question. At the Hong Kong Consensus 2026 conference, he said investors should stop trying to perfectly predict market bottoms. Instead, he suggested looking for strong entry points when prices drop.

Key points:

- Don’t obsess over calling the exact bottom

- Look for good entry opportunities during corrections

- Focus on long-term value, not short-term fear

- Think about opportunity, n

ETH-5,19%

- Reward

- like

- Comment

- Repost

- Share

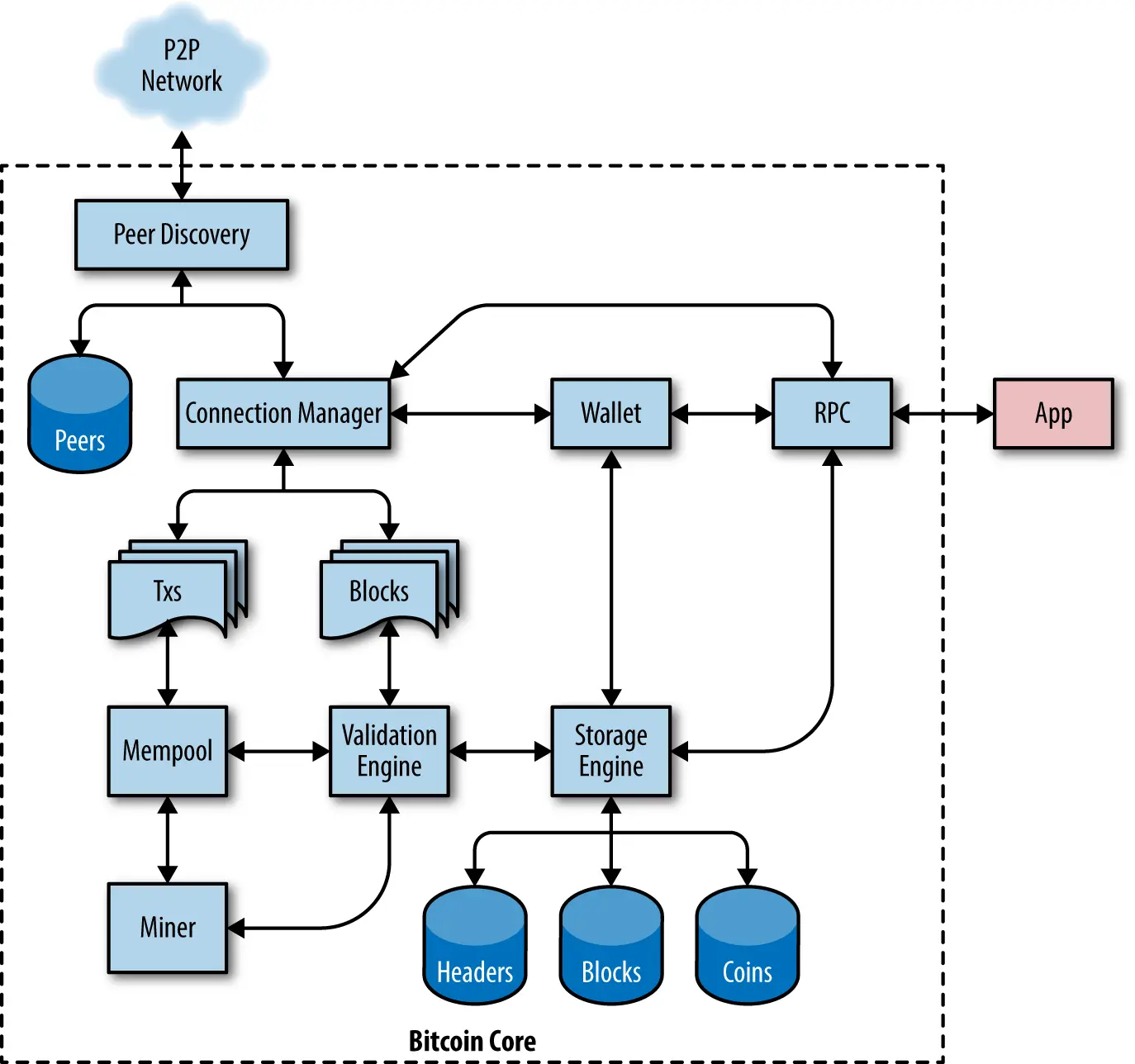

Network Update: Bitcoin Core v29.3 Released

The latest Bitcoin Core v29.3 version has been officially released.

This update is now available for download through the official Bitcoin Core website.

Key points

- Bitcoin Core v29.3 is live.

- Official release confirmed by developers.

- Available for public download.

- Focus on network stability and performance improvements.

Bitcoin Core is the reference software that helps run and secure the Bitcoin network. Regular updates are important to improve security, fix bugs, and boost overall node performance. Node operators and develope

The latest Bitcoin Core v29.3 version has been officially released.

This update is now available for download through the official Bitcoin Core website.

Key points

- Bitcoin Core v29.3 is live.

- Official release confirmed by developers.

- Available for public download.

- Focus on network stability and performance improvements.

Bitcoin Core is the reference software that helps run and secure the Bitcoin network. Regular updates are important to improve security, fix bugs, and boost overall node performance. Node operators and develope

BTC-4,59%

- Reward

- like

- Comment

- Repost

- Share

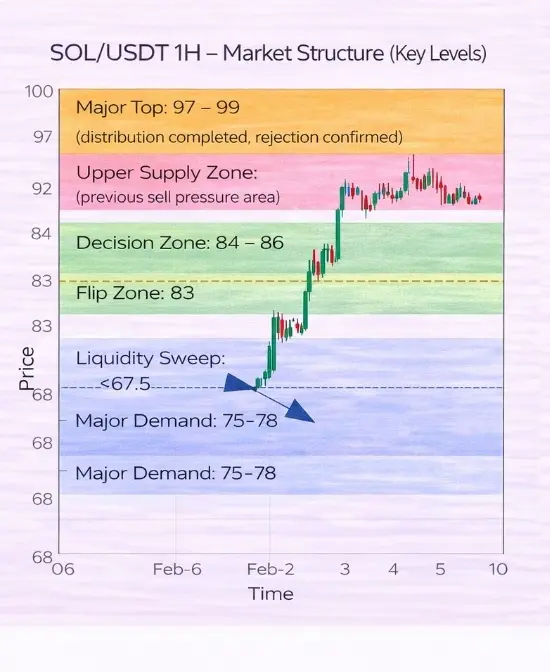

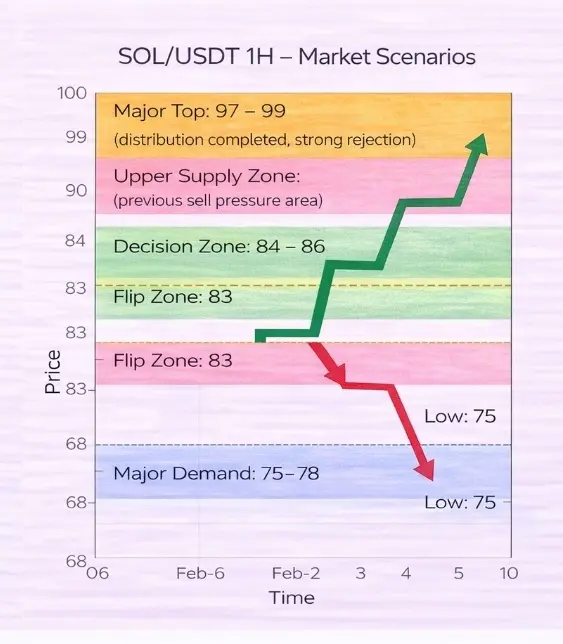

Market Is Cooling, But Structure Still Matters $SOL

Price pulled back after the expansion move.

Momentum slowed down, but structure is still in control.

SOL already completed a downside sweep near 67.5 and expanded back toward the 90 to 97 distribution area. Now price is compressing again around mid-range.

This is not random movement.

This is positioning.

Current Structure Breakdown (1H)

Major Top: 97 to 99

(distribution completed, strong rejection)

Upper Supply Zone: 90 to 92

(previous sell pressure area)

Decision Zone: 84 to 86

(current reaction area)

Flip Zone: 83

Price pulled back after the expansion move.

Momentum slowed down, but structure is still in control.

SOL already completed a downside sweep near 67.5 and expanded back toward the 90 to 97 distribution area. Now price is compressing again around mid-range.

This is not random movement.

This is positioning.

Current Structure Breakdown (1H)

Major Top: 97 to 99

(distribution completed, strong rejection)

Upper Supply Zone: 90 to 92

(previous sell pressure area)

Decision Zone: 84 to 86

(current reaction area)

Flip Zone: 83

SOL-6,57%

- Reward

- 1

- Comment

- Repost

- Share

BITMINE, Ethereum Staking Increased by 140,400 ETH

Bitmine has increased its Ethereum staking position by adding 140,400 ETH, according to on-chain monitoring data. This brings Bitmine’s total Ethereum holdings to 4,325,738 ETH. Of that, 3,037,859 ETH is currently staked, pushing the staking ratio above 70%.

Is this a sign that large holders are committing more to long-term Ethereum network participation?

$ETH #GateSpringFestivalHorseRacingEvent

Bitmine has increased its Ethereum staking position by adding 140,400 ETH, according to on-chain monitoring data. This brings Bitmine’s total Ethereum holdings to 4,325,738 ETH. Of that, 3,037,859 ETH is currently staked, pushing the staking ratio above 70%.

Is this a sign that large holders are committing more to long-term Ethereum network participation?

$ETH #GateSpringFestivalHorseRacingEvent

ETH-5,19%

- Reward

- like

- Comment

- Repost

- Share

STRATEGY | MICHAEL SAYLOR, Bitcoin Holding Update

Michael Saylor has emphasized that Strategy will not sell its Bitcoin holdings. He dismissed rumors of forced selling or liquidation risks.

In recent statements, the company confirmed its commitment to holding Bitcoin long-term, despite market changes and recent financial reporting

pressures.

Key points:

- No Bitcoin selling planned

- Rumors of forced liquidation denied

- Long-term holding strategy unchanged

- Bitcoin remains a key treasury asset

Saylor noted that the company’s Bitcoin policy focuses on long-term holding. It also

Michael Saylor has emphasized that Strategy will not sell its Bitcoin holdings. He dismissed rumors of forced selling or liquidation risks.

In recent statements, the company confirmed its commitment to holding Bitcoin long-term, despite market changes and recent financial reporting

pressures.

Key points:

- No Bitcoin selling planned

- Rumors of forced liquidation denied

- Long-term holding strategy unchanged

- Bitcoin remains a key treasury asset

Saylor noted that the company’s Bitcoin policy focuses on long-term holding. It also

BTC-4,59%

- Reward

- like

- Comment

- Repost

- Share

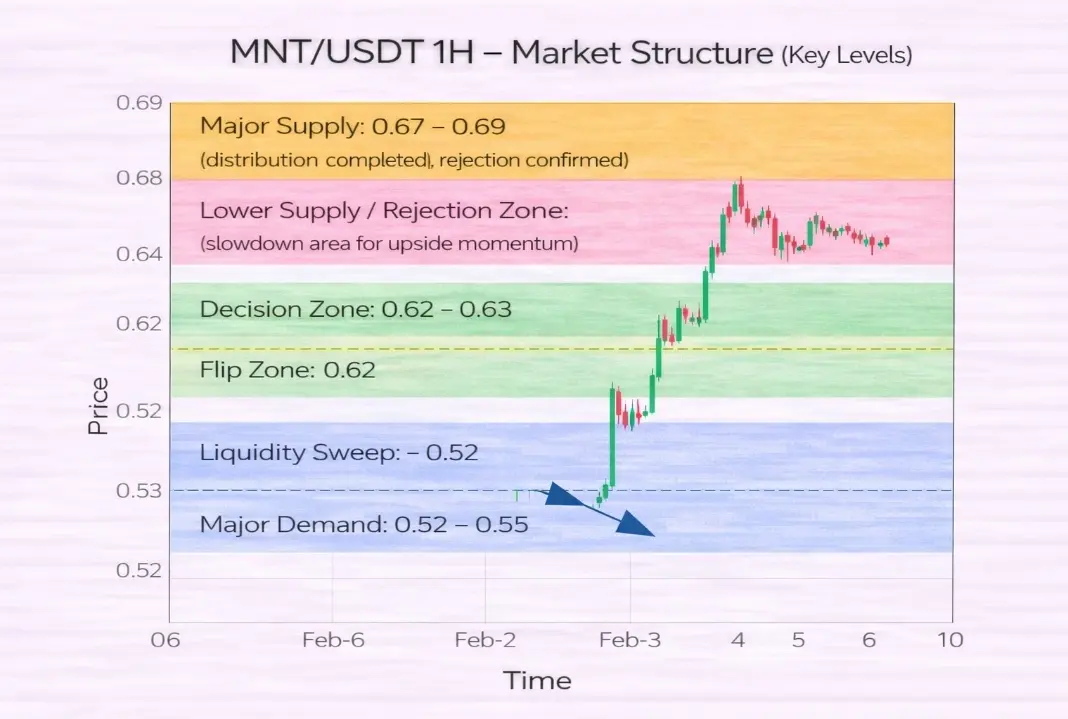

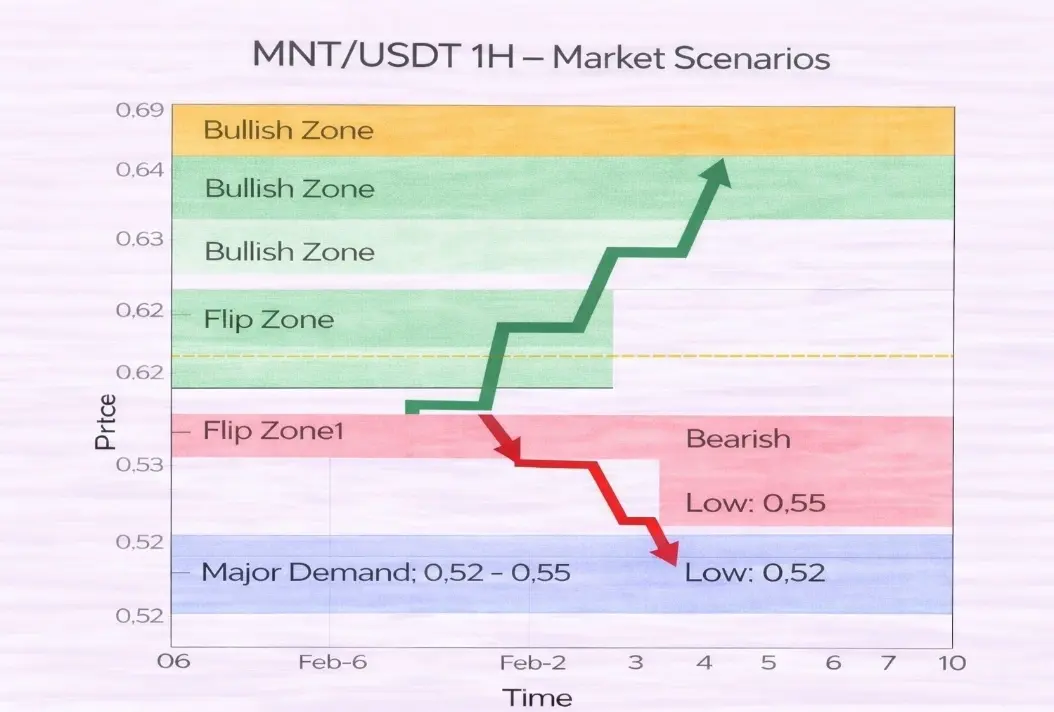

Market Is Calm, But Structure Is Still in Control, $MNT

Price isn’t moving aggressively right now, and that’s when structure matters the most. After a sharp downturn, MNT reacted strongly and entered a consolidation phase. The emotional part of the move is already over. What remains is decision and confirmation.

This is not about guessing the direction. It’s about understanding where price needs to hold.

Current Structure Breakdown

Major Supply: 0.67 - 0.69

This is the previous distribution zone where selling pressure showed up.

Lower Supply / Rejection Zone: 0.64 - 0.65

This

Price isn’t moving aggressively right now, and that’s when structure matters the most. After a sharp downturn, MNT reacted strongly and entered a consolidation phase. The emotional part of the move is already over. What remains is decision and confirmation.

This is not about guessing the direction. It’s about understanding where price needs to hold.

Current Structure Breakdown

Major Supply: 0.67 - 0.69

This is the previous distribution zone where selling pressure showed up.

Lower Supply / Rejection Zone: 0.64 - 0.65

This

MNT-3,99%

- Reward

- 1

- Comment

- Repost

- Share

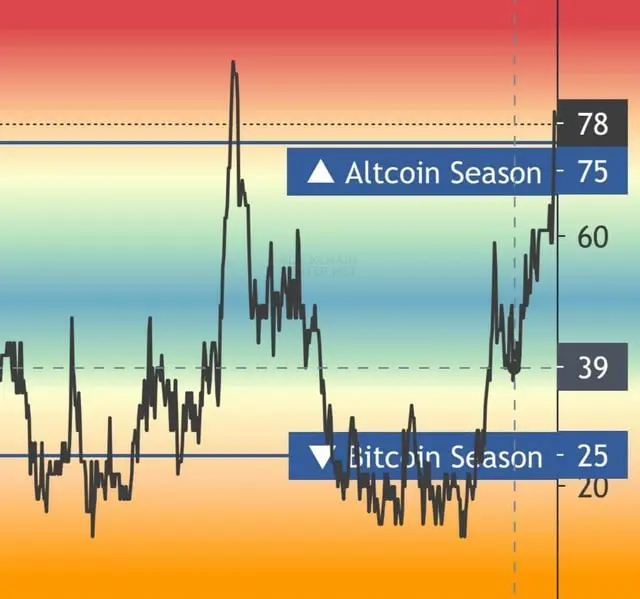

Altcoin Season Index Rises, Bitcoin Still Leading the Market

The Altcoin Season Index has moved slightly higher, but the overall market structure is still clearly driven by Bitcoin.

Key details

The index increased by 3 points, now at 27.

It tracks the top 100 cryptocurrencies, excluding stablecoins and wrapped assets.

Performance is measured over the last 90 days.

How to read this

A level of 27 means the market is still in a Bitcoin-led phase.

Most altcoins are not outperforming Bitcoin yet.

Capital remains concentrated rather than rotating broadly.

The rise is modest and s

The Altcoin Season Index has moved slightly higher, but the overall market structure is still clearly driven by Bitcoin.

Key details

The index increased by 3 points, now at 27.

It tracks the top 100 cryptocurrencies, excluding stablecoins and wrapped assets.

Performance is measured over the last 90 days.

How to read this

A level of 27 means the market is still in a Bitcoin-led phase.

Most altcoins are not outperforming Bitcoin yet.

Capital remains concentrated rather than rotating broadly.

The rise is modest and s

XRP-3,45%

- Reward

- like

- Comment

- Repost

- Share

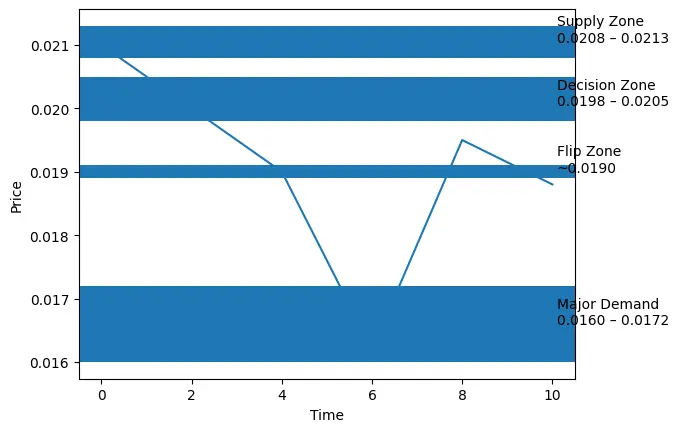

Market Is Explosive, But Structure Still Controls $MON

Price expanded aggressively, and attention returned quickly.

That’s when structure matters more than excitement.

MON already delivered a sharp upside expansion after sweeping downside liquidity.

The emotional move is complete.

Now price is reacting around a key high-risk decision area, where continuation or rotation will be decided.

Current Structure Breakdown

Major Top: 0.0213 → local expansion high

Supply Zone: 0.0208 – 0.0213 (profit-taking and rejection area)

Decision Zone: 0.0198 – 0.0205 (current acceptance range)

Price expanded aggressively, and attention returned quickly.

That’s when structure matters more than excitement.

MON already delivered a sharp upside expansion after sweeping downside liquidity.

The emotional move is complete.

Now price is reacting around a key high-risk decision area, where continuation or rotation will be decided.

Current Structure Breakdown

Major Top: 0.0213 → local expansion high

Supply Zone: 0.0208 – 0.0213 (profit-taking and rejection area)

Decision Zone: 0.0198 – 0.0205 (current acceptance range)

MON-9,08%

- Reward

- 2

- 1

- Repost

- Share

SakiullahSakib :

:

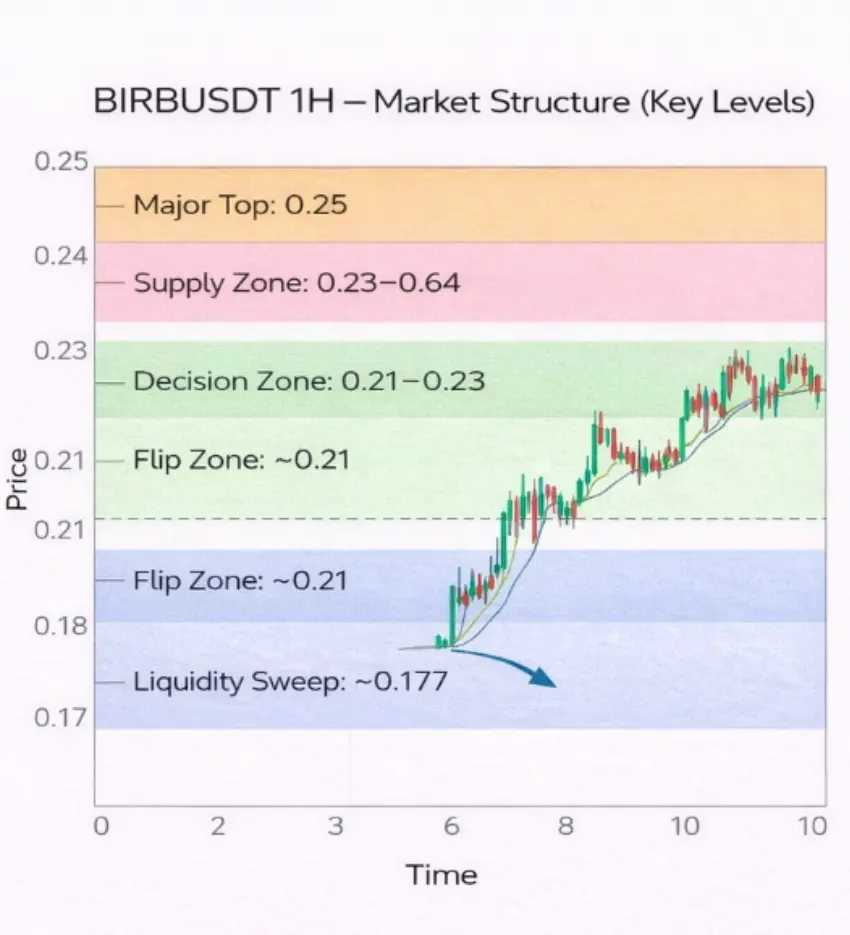

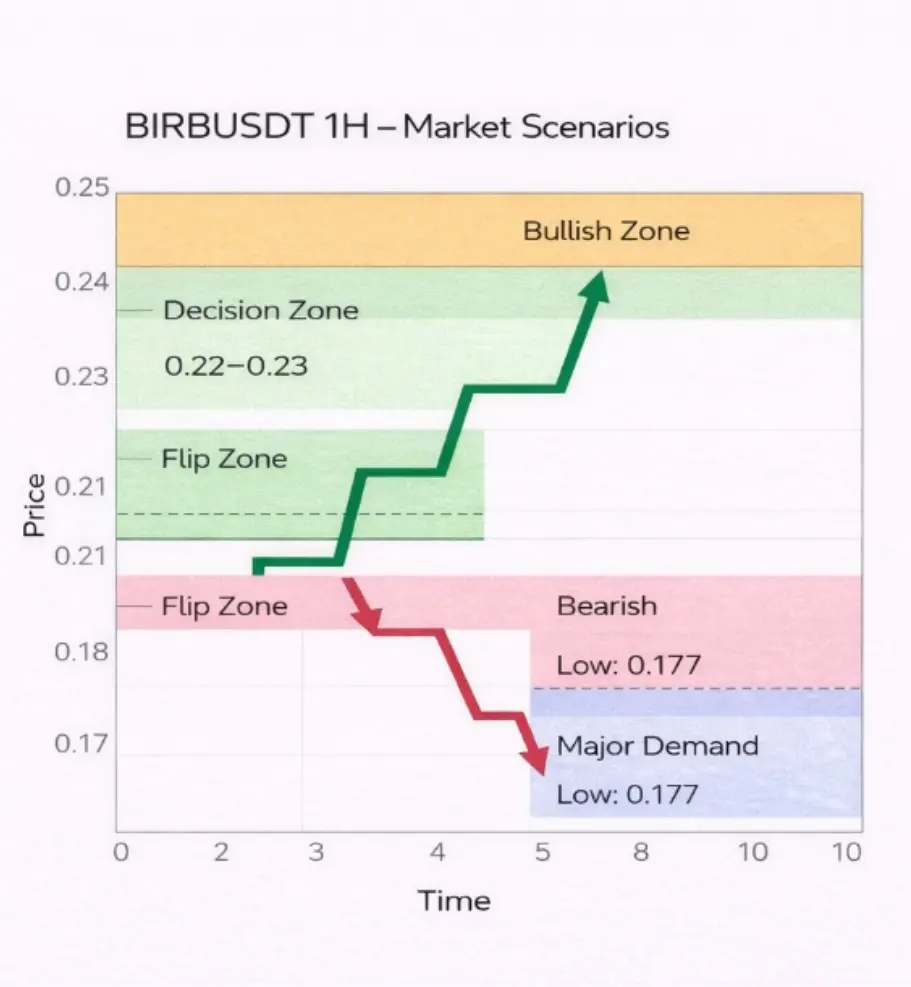

Watching Closely 🔍️$BIRB Market Looks Calm, But Structure Is Doing the Talking

BIRB had its excitement already. After a sharp spike and a quick drop from the top, the price has cooled down and entered a quieter phase. Volume is lighter, and emotions are lower. That’s when structure matters most. The hype move is over. Now, we are watching whether the market is building a base or preparing for another leg.

Current Structure Breakdown

• Major Top: ~0.34

→ Distribution completed after the spike

• Supply Zone: 0.26 – 0.28

→ Previous rejection and seller reaction area

• Decision Zone: 0.23 – 0.24

→

BIRB had its excitement already. After a sharp spike and a quick drop from the top, the price has cooled down and entered a quieter phase. Volume is lighter, and emotions are lower. That’s when structure matters most. The hype move is over. Now, we are watching whether the market is building a base or preparing for another leg.

Current Structure Breakdown

• Major Top: ~0.34

→ Distribution completed after the spike

• Supply Zone: 0.26 – 0.28

→ Previous rejection and seller reaction area

• Decision Zone: 0.23 – 0.24

→

BIRB-10,06%

- Reward

- 1

- Comment

- Repost

- Share

Whale Positioning Shift: Machi Flips Bias on Ethereum

On-chain monitoring shows Machi Big Brother is actively changing his Ethereum exposure. He is moving from a long position to a short setup.

According to data shared by Onchain Lens, Machi has:

- Partially closed his ETH long position

- Placed limit orders to start a short position

- Signaled a clear change in his short-term market outlook for ETH

Key takeaways:

- The shift from long to short suggests a tactical repositioning

- The partial close indicates risk reduction, not a panic exit

- The short was initiated through li

On-chain monitoring shows Machi Big Brother is actively changing his Ethereum exposure. He is moving from a long position to a short setup.

According to data shared by Onchain Lens, Machi has:

- Partially closed his ETH long position

- Placed limit orders to start a short position

- Signaled a clear change in his short-term market outlook for ETH

Key takeaways:

- The shift from long to short suggests a tactical repositioning

- The partial close indicates risk reduction, not a panic exit

- The short was initiated through li

ETH-5,19%

- Reward

- 1

- 1

- Repost

- Share

GateUser-09484e41 :

:

Buy To Earn 💎Policy Signal: U.S. Pushes for Crypto Market Structure Clarity

Janet Yellen stated that the Crypto Market Structure Act needs to be passed this spring. She emphasized the urgency for clear rules regarding digital assets.

In a recent interview, Yellen highlighted the importance of completing the framework and expressed hope about the bill's passage. This could mark a key moment for U.S. crypto regulation.

Key takeaways:

- Clear timeline pressure: "this spring" sets expectations

- Focus on market structure, not bans or rollbacks

- Regulatory clarity could unlock institutional participation

- R

Janet Yellen stated that the Crypto Market Structure Act needs to be passed this spring. She emphasized the urgency for clear rules regarding digital assets.

In a recent interview, Yellen highlighted the importance of completing the framework and expressed hope about the bill's passage. This could mark a key moment for U.S. crypto regulation.

Key takeaways:

- Clear timeline pressure: "this spring" sets expectations

- Focus on market structure, not bans or rollbacks

- Regulatory clarity could unlock institutional participation

- R

- Reward

- 2

- 3

- Repost

- Share

SoominStar :

:

2026 GOGOGO 👊View More

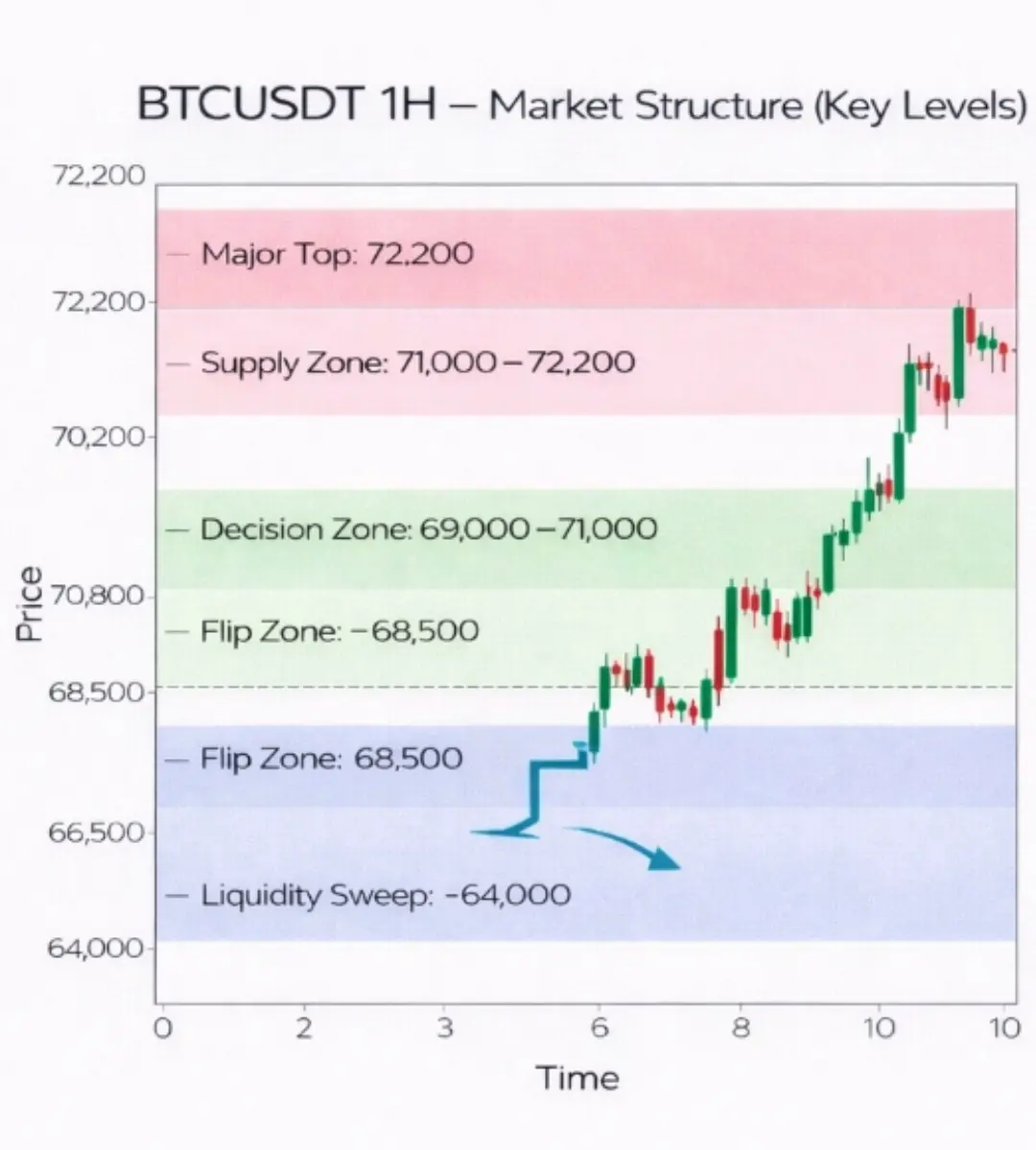

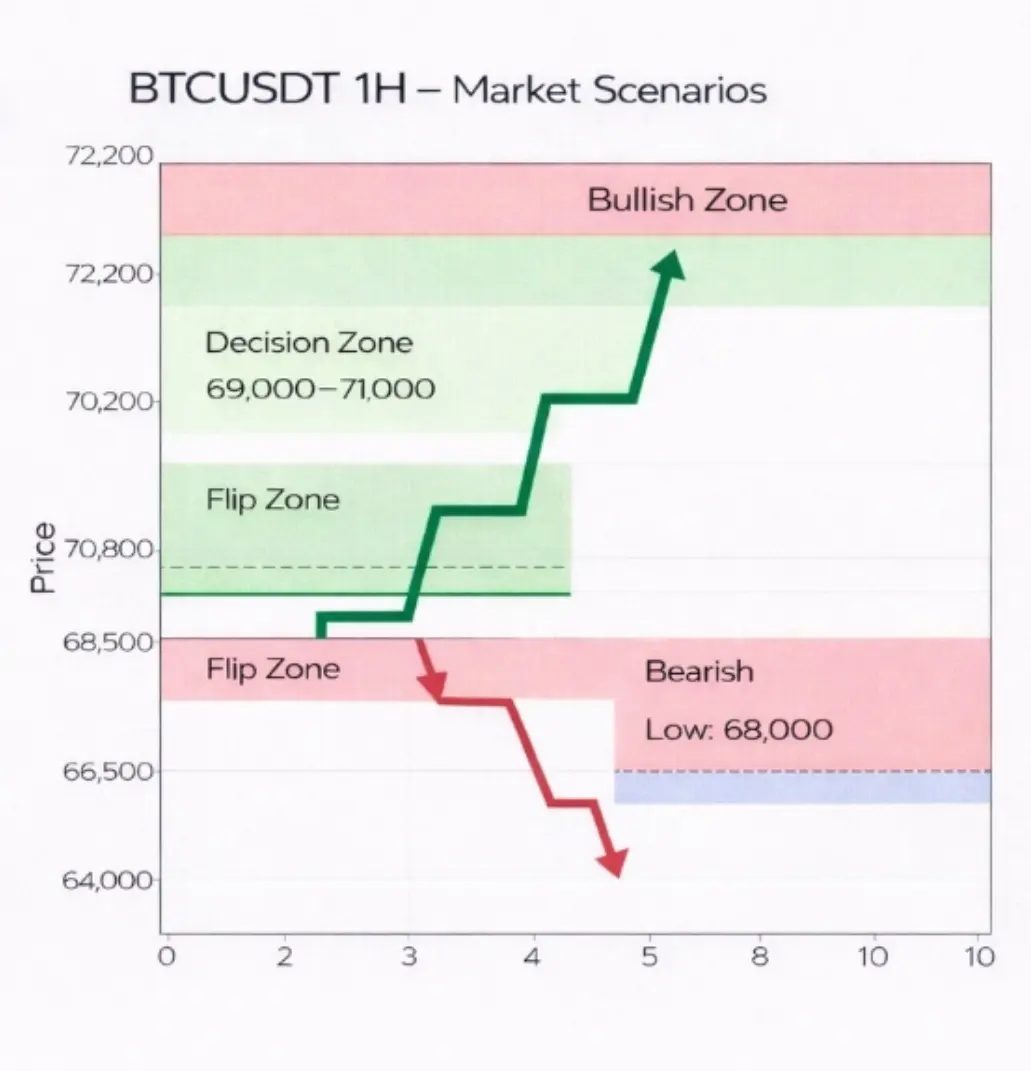

Market Is Calm, But BTC Structure Is Still in Control

Price is moving slowly and interest is fading. That’s usually when structure is most important. BTC has already made a sharp move down from the higher distribution area, cleared liquidity below, and is now stabilizing within a key higher-timeframe range. The panic phase is over. What we’re seeing now is price digestion, not direction yet.

Current Structure Breakdown

Major Top: 72.2k, distribution area

Supply Zone: 71k – 72.2k, previous rejection zone

Decision Zone: 69k – 71k, current acceptance range

Flip Zone: ~68.8k, bias-defi

Price is moving slowly and interest is fading. That’s usually when structure is most important. BTC has already made a sharp move down from the higher distribution area, cleared liquidity below, and is now stabilizing within a key higher-timeframe range. The panic phase is over. What we’re seeing now is price digestion, not direction yet.

Current Structure Breakdown

Major Top: 72.2k, distribution area

Supply Zone: 71k – 72.2k, previous rejection zone

Decision Zone: 69k – 71k, current acceptance range

Flip Zone: ~68.8k, bias-defi

BTC-4,59%

- Reward

- like

- 2

- Repost

- Share

Lock_433 :

:

2026 GOGOGO 👊View More

Macro Warning: Michael Burry Flags Miner Risk if Bitcoin Slides

Renowned macro investor Michael Burry has raised concerns about Bitcoin’s downside risk, focusing on how further price drops could affect miners.

The warning highlights a familiar situation: if Bitcoin keeps declining, high-cost mining operations may struggle for cash, which could lead to forced BTC sales, shutdowns, or even bankruptcies for weaker players.

Key takeaways:

- Bitcoin price declines have a bigger impact on miners

- High operating costs plus lower block rewards increase pressure

- Weaker miners may have to

Renowned macro investor Michael Burry has raised concerns about Bitcoin’s downside risk, focusing on how further price drops could affect miners.

The warning highlights a familiar situation: if Bitcoin keeps declining, high-cost mining operations may struggle for cash, which could lead to forced BTC sales, shutdowns, or even bankruptcies for weaker players.

Key takeaways:

- Bitcoin price declines have a bigger impact on miners

- High operating costs plus lower block rewards increase pressure

- Weaker miners may have to

BTC-4,59%

- Reward

- 1

- Comment

- Repost

- Share

Whale Positioning: $26.3M USDC Added, ETH Short Expanded

On-chain data shows a large whale wallet (ending 0x6c8) has deposited an additional $26.3 million in USDC and expanded its ETH short position again, which confirms a clear bearish stance.

This action comes even though the position currently has an unrealized loss of about $1.15 million, raising the total ETH short exposure to around $78.41 million.

Key takeaways:

- Significant USDC collateral added to support the position

- ETH short size increased despite the loss

- Suggests strong belief in the strategy, not panic managemen

On-chain data shows a large whale wallet (ending 0x6c8) has deposited an additional $26.3 million in USDC and expanded its ETH short position again, which confirms a clear bearish stance.

This action comes even though the position currently has an unrealized loss of about $1.15 million, raising the total ETH short exposure to around $78.41 million.

Key takeaways:

- Significant USDC collateral added to support the position

- ETH short size increased despite the loss

- Suggests strong belief in the strategy, not panic managemen

ETH-5,19%

- Reward

- like

- Comment

- Repost

- Share

ZK Infrastructure Shift: 99% of Blockchain Compute Moving Off-Chain

At a recent industry forum, Michael, co-founder of Brevis, shared an interesting prediction. Within the next decade, around 99% of blockchain computation will move off-chain, with zero-knowledge (ZK) proofs serving as the main verification layer.

The concept is simple yet impactful; it separates heavy computation from on-chain verification. Computation occurs off-chain while the chain only verifies concise, low-cost proofs. This model greatly improves scalability while maintaining trust and privacy.

Key takeaways:

- Ma

At a recent industry forum, Michael, co-founder of Brevis, shared an interesting prediction. Within the next decade, around 99% of blockchain computation will move off-chain, with zero-knowledge (ZK) proofs serving as the main verification layer.

The concept is simple yet impactful; it separates heavy computation from on-chain verification. Computation occurs off-chain while the chain only verifies concise, low-cost proofs. This model greatly improves scalability while maintaining trust and privacy.

Key takeaways:

- Ma

BTC-4,59%

- Reward

- like

- Comment

- Repost

- Share

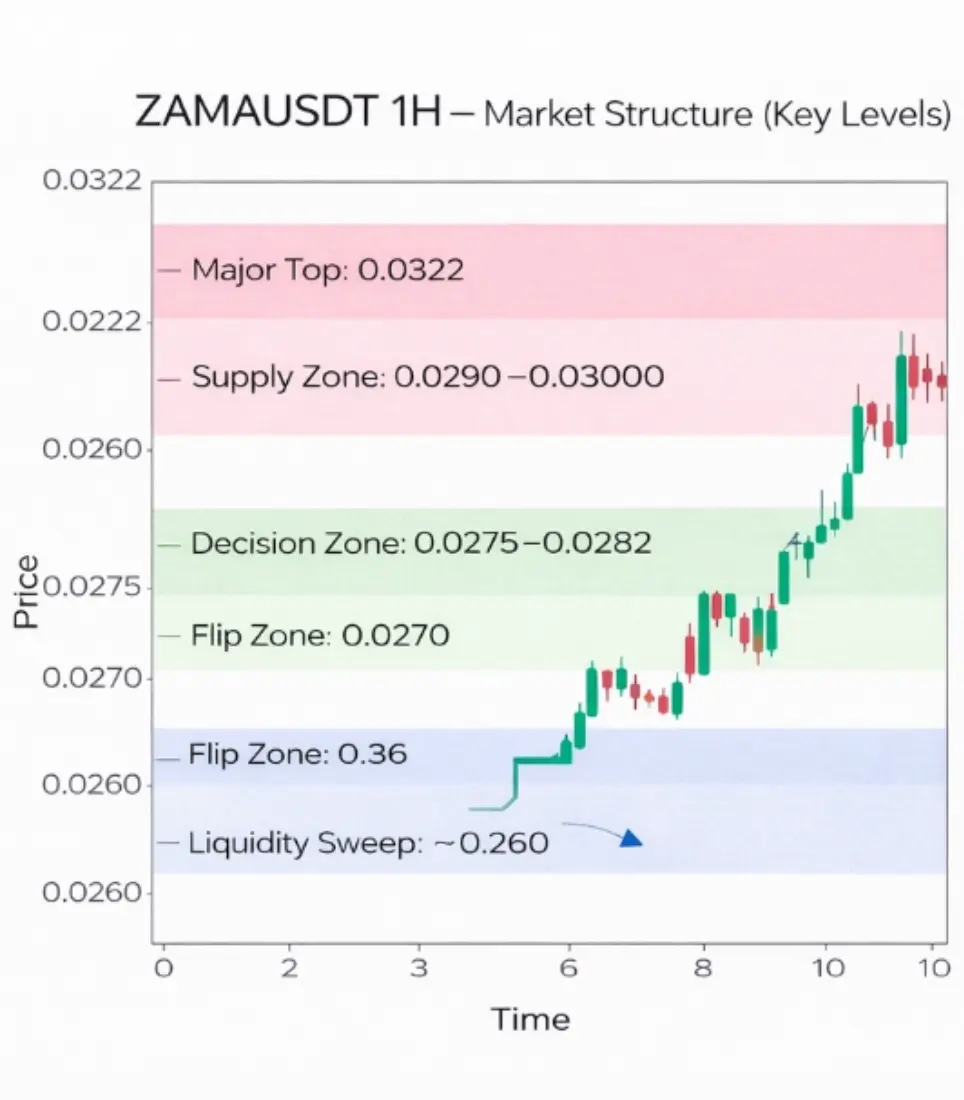

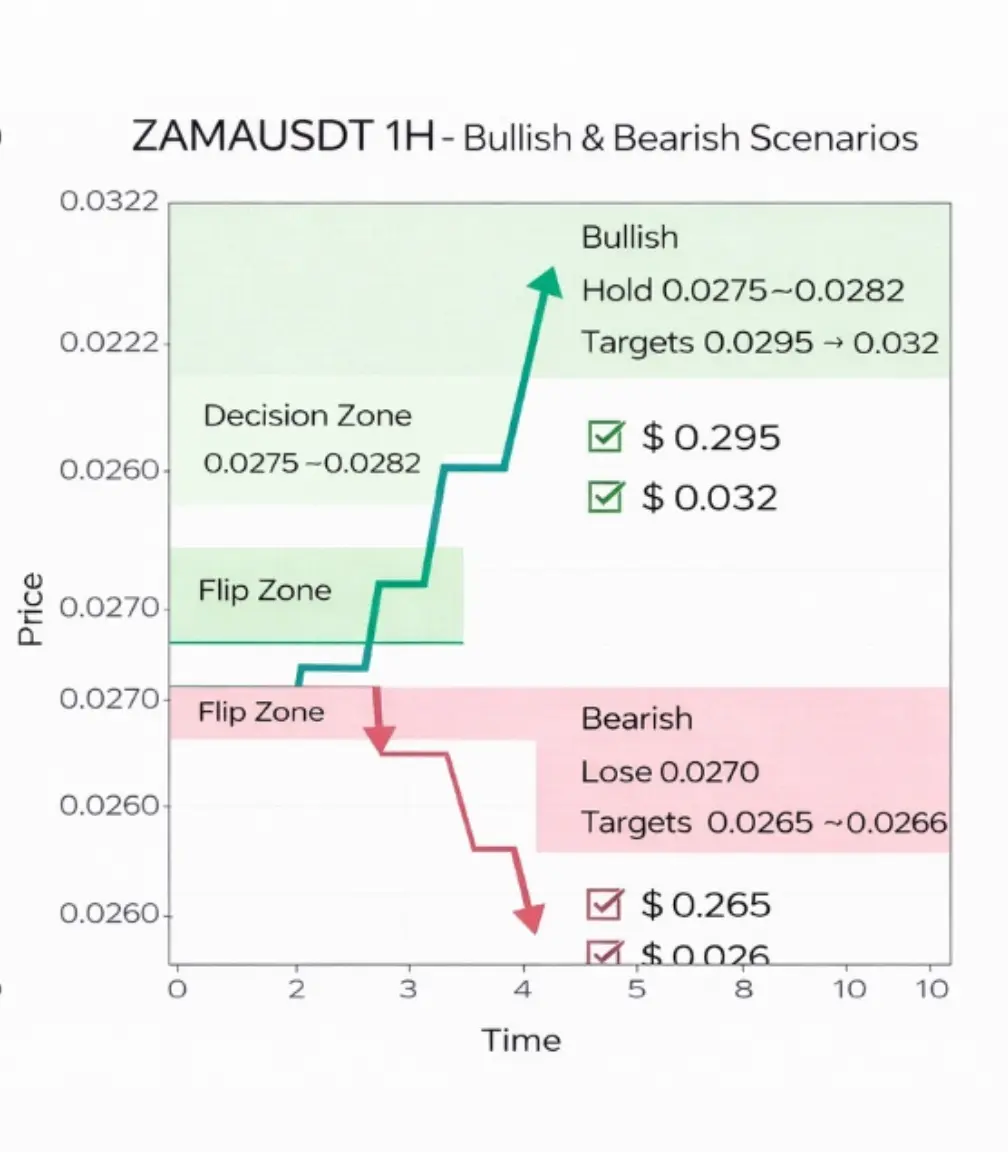

$ZAMA Market Is Quiet, But Structure Is Doing the Talking

Price is drifting, and most traders are losing interest. That’s usually when structure matters the most. ZAMA already rejected from the local top, flushed weak hands into lower liquidity, and is now stabilizing inside a key decision range. Panic already happened. What we’re seeing now is digestion, not trend resolution yet.

Current Structure Breakdown

Major Top: ~0.0322, distribution complete

Supply Zone: 0.0290, 0.0300 (previous rejection area)

Decision Zone: 0.0275, 0.0282 (current acceptance range)

Flip Zone: ~0.0270 (l

Price is drifting, and most traders are losing interest. That’s usually when structure matters the most. ZAMA already rejected from the local top, flushed weak hands into lower liquidity, and is now stabilizing inside a key decision range. Panic already happened. What we’re seeing now is digestion, not trend resolution yet.

Current Structure Breakdown

Major Top: ~0.0322, distribution complete

Supply Zone: 0.0290, 0.0300 (previous rejection area)

Decision Zone: 0.0275, 0.0282 (current acceptance range)

Flip Zone: ~0.0270 (l

ZAMA-20,33%

- Reward

- like

- 1

- Repost

- Share

GateUser-4b9f8191 :

:

Idiot, you must be a member of the promotion team. Stupid token.